Set Up A Limited Company

Set up a limited company today. We can help with all aspects of company formation and registration; providing ongoing guidance to help your business grow.

When setting up a limited company, it's vital to understand your options for company structure, register for taxes, appoint directors, and other key considerations. Our comprehensive guide explores these essential steps to help simplify your journey.

Setting up a limited company offers numerous advantages, allowing you to present a professional image to your clients and optimising tax efficiency. However, before diving into the process, there are some key factors to consider.

Firstly, you must appoint Shareholders and Directors and provide HMRC with a registered company address. Additionally, you must also decide which limited company structure you’d prefer to adopt:

The three primary types of legal entities are:

After successfully registering your company, it is highly advisable to establish a dedicated business bank account solely for your business-related transactions. Maintaining a clear separation between your personal and business finances is strongly recommended by our team, as it simplifies expense management and ensures smoother tax payments.

When selecting a bank account provider, there are some important considerations. These include the availability of schemes such as the Financial Services Compensation Scheme (FSCS) and Confirmation of Payee, as well as any additional transaction charges that may apply.

With a multitude of providers to choose from, you’ll be able to find the ideal bank account that aligns with your business requirements.

Once your limited company is established, it is essential to address your new tax obligations. Registering for business tax is the next crucial step in the setup process.

Below is a summary of the most common types of tax you will be required to pay. You can find further information regarding any potential taxes that may apply to you and your limited company dependent on your business activities in the ‘Taxes’ section later in this guide.

Understanding your tax obligations as a new limited company owner can take time and effort. Our business tax advice service is available to ensure that you maintain tax compliance and make informed decisions regarding your tax obligations.

Find out more about tax in our UK Tax Rates, Tax Allowances and Tax Bands article.

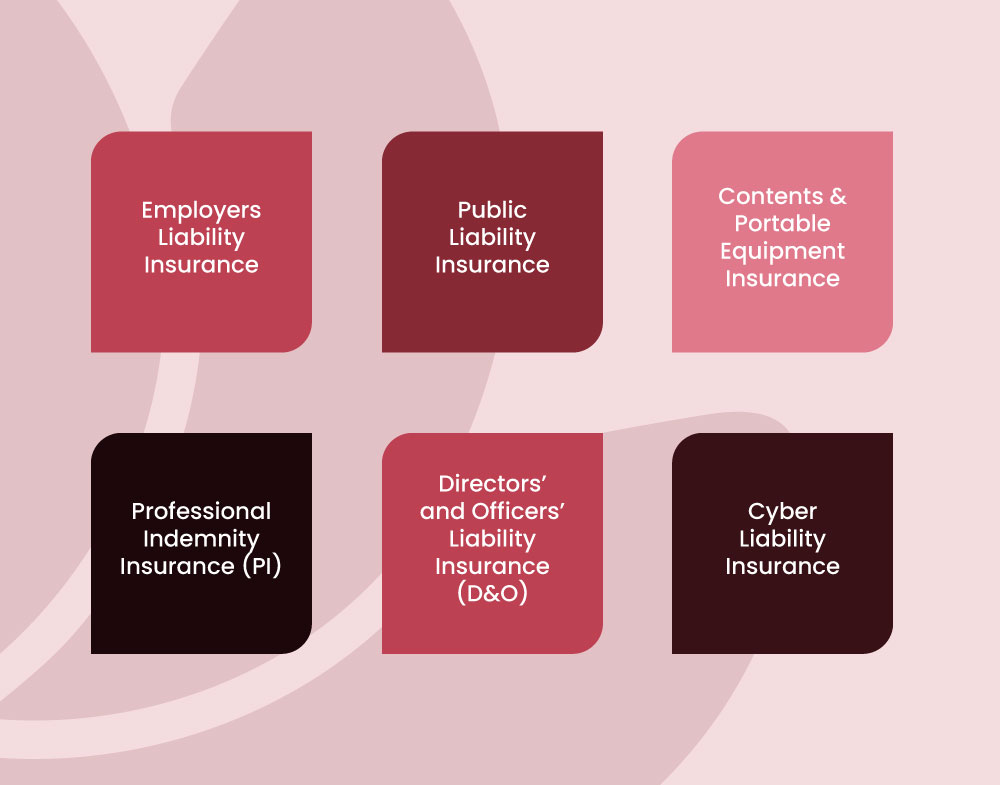

Investing in comprehensive business insurance is crucial when starting your new limited company to help protect your business against unexpected events and potential financial losses.

Business insurance can cover many scenarios, including workplace accidents and general business interruptions. While it is mandatory to have Employers Liability Insurance (once you become an employer), it is also advisable to consider other types of insurance. These may include:

As detailed earlier in this guide, one of the essential steps in starting your new limited company is appointing company directors, as mandated for any UK-based company.

Directors play a vital role by acting on behalf of the company and undertaking various duties and legal obligations. They assume the responsibility of managing the company’s operations on a day-to-day basis and are accountable for the company as a legal entity.

While there are different types of directors, they all bear similar legal responsibilities. By understanding and fulfilling these responsibilities, directors contribute to the effective governance and compliance of the company.

Set up a limited company today. We can help with all aspects of company formation and registration; providing ongoing guidance to help your business grow.

Practical business tax advice for limited companies and sole traders. Let our team of experienced business tax advisors support you.

We offer a full range of services. To find out more and get a free no obligation quote, please get in touch today

If you have any questions about our services or would like more information, you can start a live chat with one of our team.